The Future of Digital Wallets: From Payments to SuperApps

4 December 2023

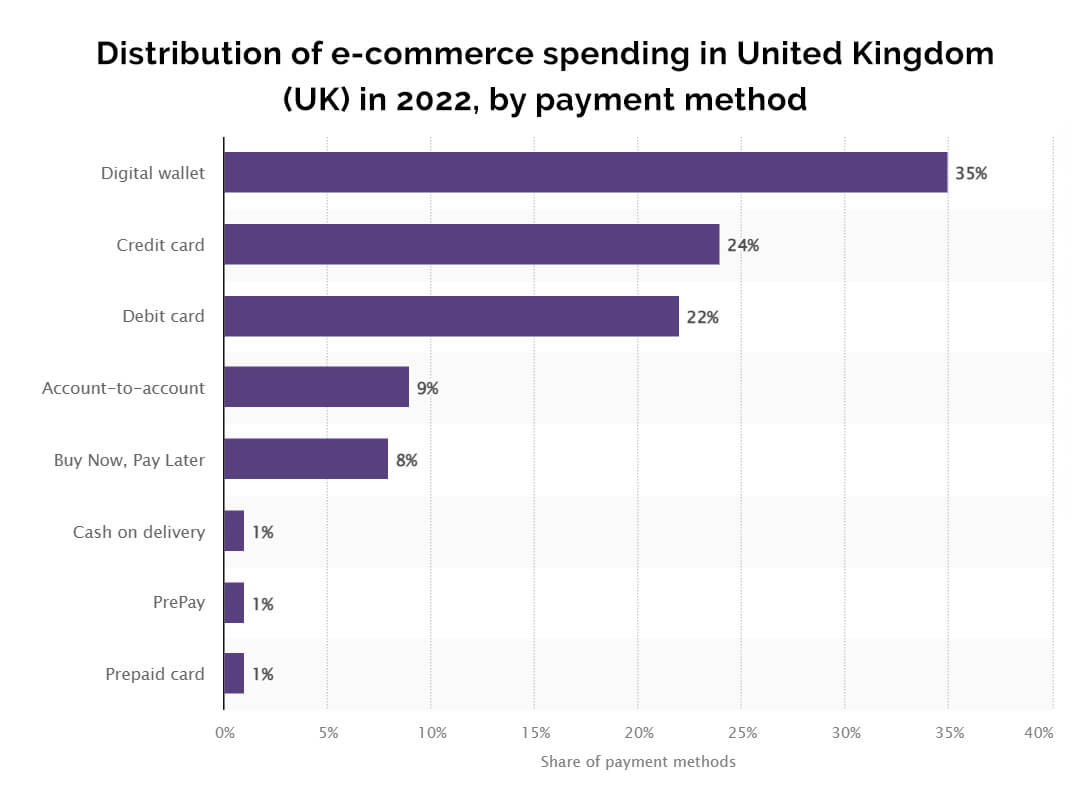

According to Statista’s 2021 survey, nearly everyone in the country uses PayPal at least once a year. ApplePay has also become the most widely used payment system for stores and restaurants, which shows that people are whipping out their phone to pay rather than taking out a card. For eCommerce spending (online shopping), digital wallets are the most popular form of payment, with popularity standing at 35%.

Even credit cards stand far behind at 24%, followed by debit cards at 22%. The ease with which people can use a digital wallet app to make secure payments has made them the most preferred option among users.

The infographic below offers insights into the preferred payment systems for eCommerce users.

This article explores the journey of digital wallet technology and how they have become an increasingly predominant part of our daily lives.

What is a Digital Wallet?

A digital wallet is a simple software application that can run on any connected device for making payments and other financial transactions. It can securely store sensitive information like IDs and passwords on the Cloud.

Pros of Digital Wallets

- They allow quicker transactions, which makes it easier to conduct day-to-day activities in a fast-paced life.

- They can serve various forms of financial transactions like paying bills, ecommerce shopping and in-store payments.

- Users don’t need to carry an additional device such as a card with them. A digital wallet app can be installed into your existing smartphones, tablets and PCs.

- Anyone can use them for domestic as well as international payments.

Cons of Digital Wallets

- They require a stable internet connection for transactions.

- Hackers can gain sensitive data by using malware on user’s devices during mobile payments

- It is easier to perform unauthorised transactions with any of the digital e-wallets.

- Some merchants are still reluctant to use mobile wallets over traditional card payments.

- There have been multiple instances of people using fake digital wallet apps to deceive merchants.

Evolution of Digital Wallets from 1997 to 2023

The journey of digital mobile wallets can be traced initially to online payment solutions, which began in 1997 with Coca-Cola. The beverage company allowed people in Helsinki to buy cold drinks via SMS. Two years later, in 1999, PayPal laid the foundation for transforming eCommerce payments with secure digital intermediaries.

Two decades later, Google released its first digital wallet app, which was released as Google Wallet. Subsequently, Apple Pay was released on the 20th of October 2014.

Amid the rise of all these payment systems, Bitcoin emerged in 2009, forming the basis of crypto wallets, an alternative to traditional digital wallets. However, what revolutionised the way people make transactions is Google Pay; the application was the first of its kind, allowing consumers to pay directly through their smartphones. This limited the use of credit and debit cards and promoted the use of contactless payments via any mobile device. Soon, digital wallet payments started gaining pace across various mobile devices.

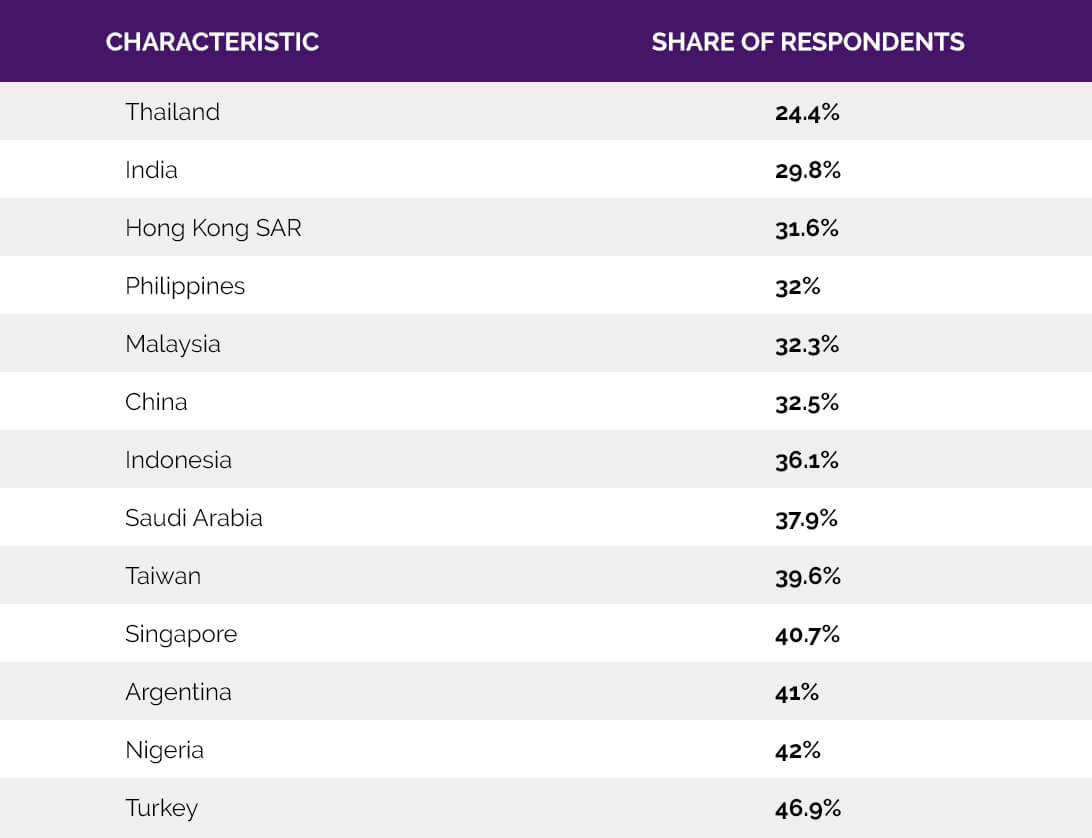

Statistics show that nearly 2.8 billion mobile wallets are in use worldwide, and almost half of these are in the Asia-Pacific region alone. The ever-increasing rise in the use of digital wallets has been noticeable, and ultimately, various custom software development companies have started offering their development & integration services.

The infographic below offers insights into the use of mobile wallets across various global nations.

Companies can enhance their conversion rates significantly by offering the use of digital wallets & other in-app payment solutions. You can understand why from the forecasts, which indicate that by the end of 2025, global transactions of more than 9 billion US dollars will be made through online payments.

The Rise of Digital Wallets in Super Apps

Super apps have become quite popular among users, offering several functional features over a single platform. For example, people can use WhatsApp for messaging, shopping and making payments. The optimum mix of several advanced features across the same platform significantly improves UX. Super apps are also popularly called ‘multi-service tech platforms.’ The integration of digital wallets within super apps makes them an ideal combination for performing various tasks.

They are unique because users need not switch to different apps and only have to sign in to a single application. Various super apps rapidly adopt digital payments and transfers to tap their existing user base for greater engagement. It also opens the door for providing users with access to several simple and complex financial operations.

Some Famous Super Apps

The WeChat application started its journey as a simple messaging platform in China and has come a long way since then. Nowadays, people can use this application for versatile purposes like accessing entertainment, digital payments and making doctor appointments.

Grab

Grab was initially launched as a ride-booking application in the Southeast Asia region. The application nowadays allows people to request food deliveries and insurance services, make digital payments, and many more functional features.

The journey of WhatsApp from a messaging platform to a super app has not been very fast-paced but undoubtedly successful. The platform leverages its massive user base to expand to various key features like digital payments, e-commerce, and more.

Emerging Technology Trends with Digital Payments

The emergence of various advanced technologies like AI and ML has offered scope for further strengthening digital wallets or online payment solutions. Fintech software development combining emerging technologies with digital wallets can play a pivotal role in creating disruptive solutions.

Predictive Analysis

You can combine digital wallets with predictive analysis for developing personalised UX for app users. Business transactions can be made more seamless with predictive analysis.

Read also: Personalising eCommerce Shopping Experience with AI

Enhanced Authentication

Integrating digital wallets with smartphones and any other device biometrics helps strengthen the wallet’s security. Global digital wallets are already leveraging this combination to gain greater user credibility. Moreover, it also fast-tracks the payment processes.

Crypto Wallet

Cryptocurrency wallets are also gaining popularity as various merchants have already started accepting them as standard forms of digital payments. Moreover, they are always more secure, which makes them an ideal fit for the fintech industry.

Wrapping Up

This was about how digital wallets have become a common feature of most fintech apps and solutions. Based on the specific industry requirements, anyone can integrate them into their existing software solutions.

At Chilliapple, a software development company, we can help you with the seamless integration of digital wallets and other fintech-related services.